Senators Introduce 36% APR Legislation for All Consumers

On Friday, December 15, 2023, Senator Jack Reed (D. Rhode Island) introduced the Predatory Lending …

Frequently Asked Questions: Compliance with the Military Lending Act

Updated November 23, 2021 We’re here with answers to NPA members’ recent questions on Military...

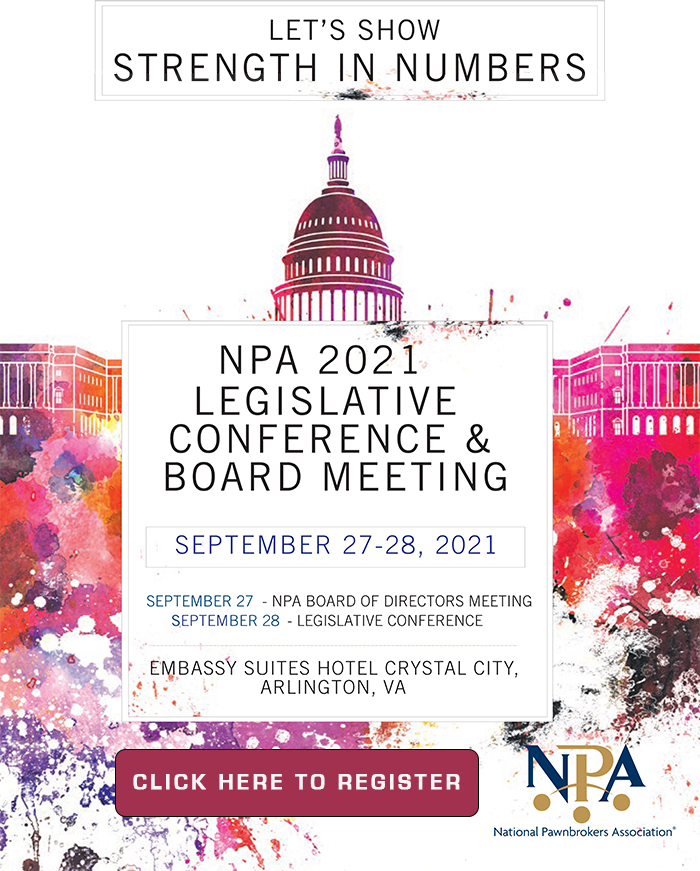

36% Rate Cap Bill filed in the U.S. House of Representatives

On November 15, 2021, H. R. 5974 the Veterans and Consumers Fair Credit Act was introduced by Rep. Jesus G. …...